Budget Diary is a series that shows how real people budget by asking them to document their budget over a typical month and reflect on their spending and saving habits. Email vlai@nerdwallet.com to be featured.

First comes love, then comes marriage — and then comes the joint savings account .

Rebecca and Mitch Slater, who live in the Twin Cities, started tackling their finances as a couple after getting married in September 2017. They follow a version of the zero-based budget , which is about allocating every dollar to expenses, savings and debt payments.

Their frank conversations about money started in summer 2016, when they were newly engaged but still in a long-distance relationship. After Rebecca’s car got totaled in an accident, Mitch flew from Chicago to Minnesota to help her go car shopping, which prompted in-depth discussions about their financial situations.

Today, they regularly set aside time to plan out their spending using YNAB, a personal budgeting software. The couple takes a more flexible approach to budgeting, in which they allocate amounts to categories but are OK with moving things around.

“We’re still figuring out how to live together and budget together, but we have a monthly budgeting date night,” says Rebecca, who has paid off $25,000 in student loans since starting to tackle her debt as a part of a couple and using the “pay yourself first” model with her business profits. “We pour a couple of glasses of wine, sit at the desk in the kitchen and budget for the next month.”

We asked the Slaters to break down their spending for February and reflect on how they did, both individually and as a couple.

Diary entries have been edited for clarity and length.

Names: Rebecca and Mitch Slater

Ages: 32 (Rebecca) and 41 (Mitch)

Occupations: Self-employed photographer (Rebecca), ecologist/environmental scientist (Mitch)

Location: St. Paul, Minnesota

Annual salaries: Mitch (around $50,000), Rebecca (between $45,000 and $55,000), combined total: around $100,000

Monthly combined take-home pay after taxes: $4,400. Note: This is the combined take-home pay that they use to figure their monthly household budget and excludes things like tax withholding, 401(k) contributions, and medical and dental insurance premiums.

February budget

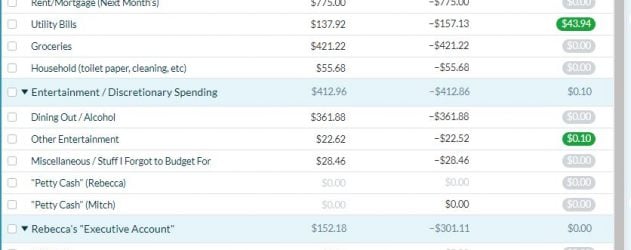

Editor’s note: The amounts listed below reflect the couple’s allocated spending — how much they predicted they would spend on various categories in February — versus actual expenses.

Mitch and Rebecca explain how they incorporate other budgeting principles:

“We have a shared personal-budget and Rebecca’s business budget in YNAB. With YNAB as the ‘engine’ to keep our budgets working and on-track, we’ve been able to sprinkle in some other, broader principles, like Dave Ramsey’s “debt snowball” method to pay off loans (paying off debts from smallest to largest), incorporating the Profit First method into Rebecca’s business finances (accounting for profit, taxes and her own pay before spending anything else) and a little FIRE movement (maximizing savings to retire early) and travel hacking (using points and miles for free or discounted flights) just for good measure.

“Here is a general breakdown of how we have our categories set up and what we typically allocate to each category at the beginning of the month. We each have our own executive accounts that we can spend however we want, without question or judgment.”

Immediate obligations (total: $1,400)

- Rent: $775

- Utilities: $125

- Groceries: $450

- Household: $50

Entertainment / discretionary spending (total: $350)

- Dining out and alcohol: $300

- Other entertainment: $50

Miscellaneous (cash on hand): $50

Rebecca’s “executive account” (total: around $315)

- Gym membership: $155

- Personal care items: around $85

- Clothing: $50

- Other miscellaneous: $25

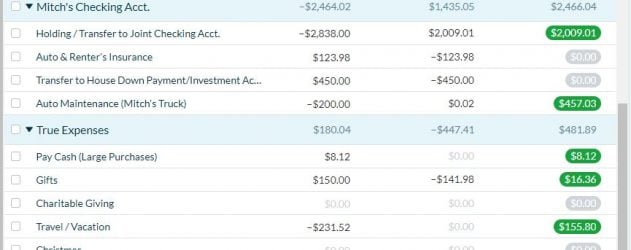

Mitch’s “executive account” (total: $75-$100)

- Fuel/transportation: $25-$50 (I usually bike or get dropped off at work)

- Clothing: $25

- Other miscellaneous: $25 (will occasionally surge to cover other expenses)

Debt payments and investments

- Auto loan: $500

- House down payment and investment money: $1,000 (Note: We have automatic transactions set up to transfer money from our separate checking accounts to a savings account and then from that savings account to a brokerage account for stock market investments)

How it looks in YNAB

</p>

</p>

</p>

</p>

How did you feel about your February budget and spending?

Rebecca: February in the Twin Cities proved to be a cold one (hello, Polar Vortex) and the snowiest February on record, so there weren’t many social activities. I had a surprise expense — a gold one. Unfortunately, that was in the form of a dental crown. We also have an annual tradition to celebrate Valentine’s Day together at home.

In the late morning between photo shoots, I went to our favorite fishmonger and picked up a couple pounds of mussels to prepare later that night for Valentine’s Day. The meal was paired with a cheese plate, crostini and wine. While we typically cook most of our meals at home, we did splurge a bit more on this one. I also noticed a sale and picked up a few clothing items to surprise Mitch with. This was unplanned spending and came out of my personal clothing budget I had been saving for an upcoming trip.

Mitch: Overall, I think the month went pretty well. There was some overspending [in Rebecca’s executive account and in the medical category because of the dental crown], but we were able to adjust by moving some money out of what I kind of consider our “slush” categories (miscellaneous and other entertainment). In other categories, we came in under budget for the month. We splurged a bit on our Valentine’s Day meal and drinks at home, but it didn’t break the budget, and fortunately, Rebecca’s dental work will be reimbursed from our flex-spending account.

I also had to renew my vehicle registration and decided to extend my gym membership for a couple more months, so that money had to be rolled out of the auto maintenance category and into my “other miscellaneous” category. (It might look a little wonky to folks who are familiar with YNAB, but that’s how I did it to keep our account balances in order, due to the way we have the categories organized).

Ultimately, we were able to go over our monthly allocation for February because we hadn’t spent all of our money in previous months and were able to carry that money forward, which provided additional flexibility in the budget.

Would you have done anything differently?

Rebecca: I would have been more realistic on our gift budget. I love to give gifts, even little ones. With Valentine’s Day and attending our friend’s wedding shower and wedding, our gift budget was depleted fast.

Mitch: Honestly, not too much — at least not for the month, specifically. I think that as we start to check off some of our mid-term goals and already-planned expenditures (e.g., our vacation this summer), we will have to address how we want to start planning for and prioritizing future, large-ish expenditures and how much we want to be setting aside each month to save up for them. That’s probably the biggest change I think we will have to address.

What advice would you give to other individuals or couples?

Rebecca: Both people in the partnership need to be “all in” about the decision to budget. Talk about your purchases before making them. What is your “why” that is driving the purchase in the first place?

Target run? Go together. Want a new shirt (or for me, Lululemon workout pants)? Give yourself time to make a thoughtful decision and look in your closet first to see what you already own. Sit down and budget together every two weeks. Make it a date. This will give you the chance to look at the numbers from the previous month and then plan for the next month. Make the adjustments as needed. When you get into a rhythm, you can move that budgeting date to once a month.

Mitch: Don’t let “perfect” be the enemy of “good enough.” If you’re new to budgeting or tried it and gave it up, get back to it and do the work! The first few months will be the hardest, and you may have to make some difficult decisions based on the realities of your finances. Just remember that the budget is a tool to help you make financial decisions. As you become more and more proficient with your budget, it can become a powerful tool to help you accomplish your financial goals.

I’ll also add that every month always seems to have “something” that makes it unusual as far as budgeting goes. Doing your best to plan for those “somethings” and giving yourself a little bit of wiggle room to deal with the things you didn’t anticipate makes a world of difference in how you will feel about budgeting.

Photo courtesy of Kylee Leonetti.

More From NerdWallet

The article Budget Diary: ‘Budgeting Date Nights’ Help One Couple Stay On Track originally appeared on NerdWallet.